Its been more than 10 years I've been a customer of Charles Schwab Singapore (previously known as OptionsXpress Singapore).

I've been using this platform for my US Stock/options investing over years, now its time to switch to another Financial Institution Platform.

Attached information regards to its closure for your reference. By end of 2019 Singapore account holders have to close/liquidate positions as they are unable to port our account to US head office due to local monetary authorities regulations.

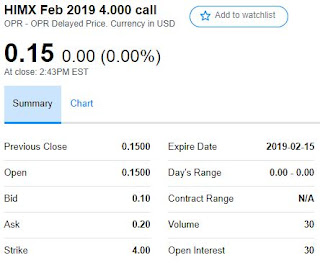

I'll continue till November, then liquidate my account and make my withdrawals. I'll be switching to Ameritrade. But my blog will continue under a fresh new account and record.

I'll capture my last summary and post it on my blog on end 2019.

Links: https://www.channelnewsasia.com/news/business/charles-schwab-to-close-singapore-office-11875640